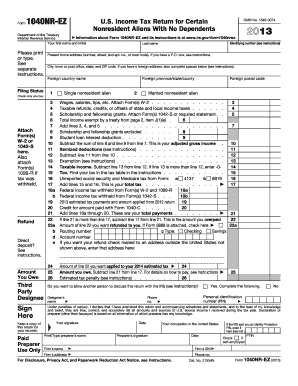

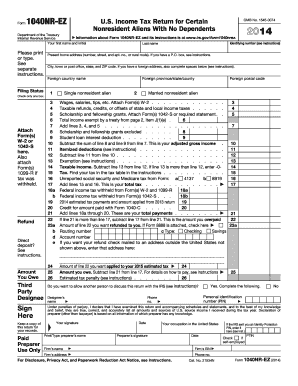

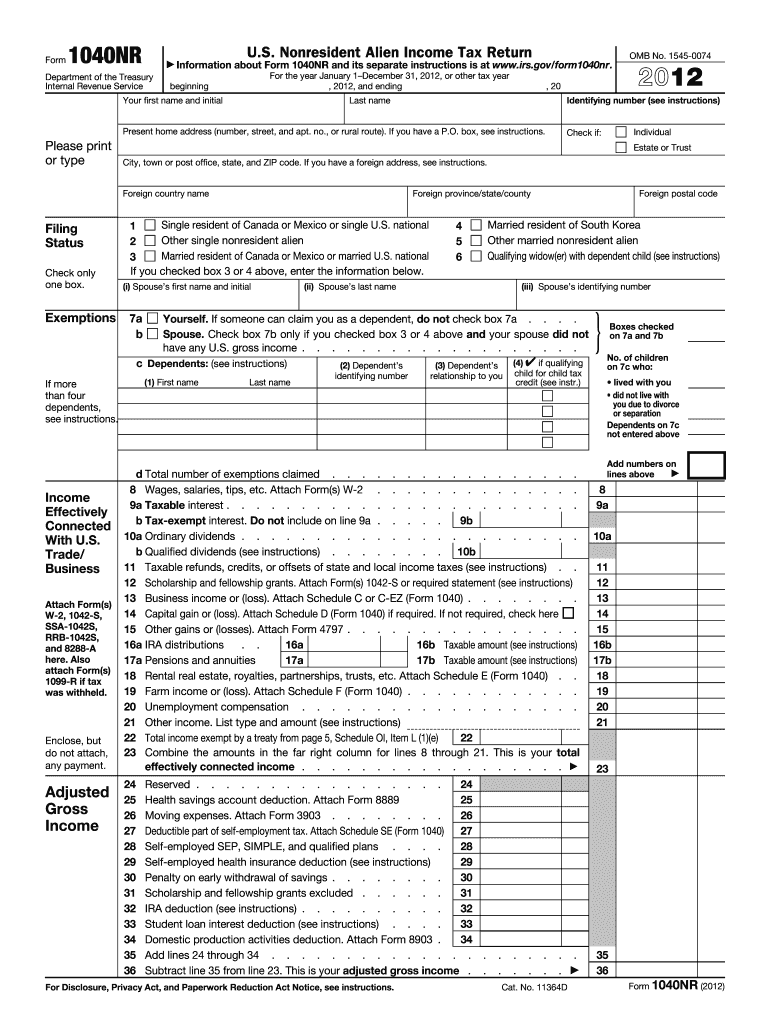

IRS 1040-NR 2012 free printable template

Instructions and Help about IRS 1040-NR

How to edit IRS 1040-NR

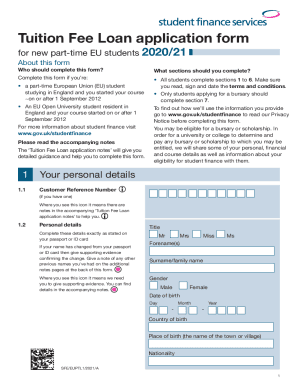

How to fill out IRS 1040-NR

About IRS 1040-NR 2012 previous version

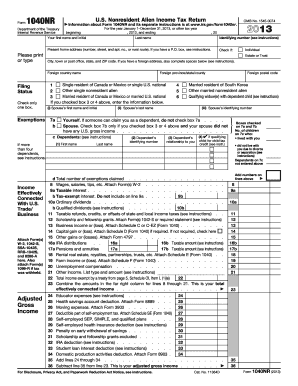

What is IRS 1040-NR?

Who needs the form?

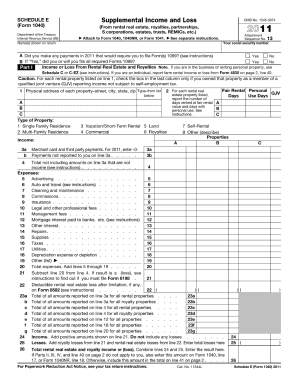

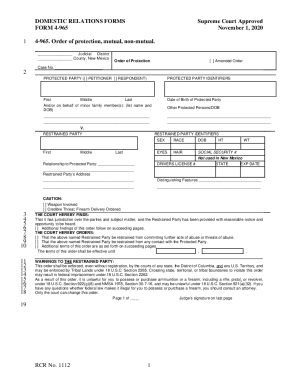

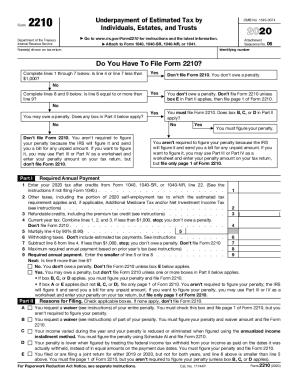

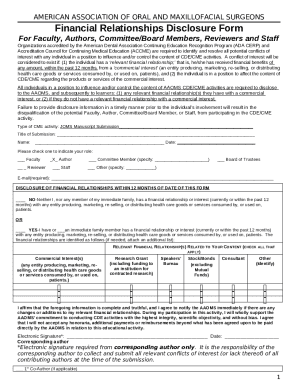

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1040-NR

What should I do if I realize I've made an error on my nj 1040nr after already filing it?

If you've made a mistake on your nj 1040nr, you'll need to submit an amended return. This involves completing a new form and clearly marking it as 'amended.' Be sure to include the changes you've made and any supporting documentation. It's important to address any errors as soon as you notice them to avoid potential penalties.

How can I track the status of my filed nj 1040nr?

To track the status of your nj 1040nr, you can visit the New Jersey Division of Taxation website and use their online tracking tool. You'll need to provide personal information like your Social Security number and filing details. This tool can help you verify whether your filing has been received and is being processed.

What common errors should I watch out for when filing the nj 1040nr?

Common errors include incorrect Social Security numbers, mismatched names, and calculation mistakes. Additionally, ensure that all required fields are filled out completely and accurately. Double-checking your entries can help you avoid delays and complications during processing.

Can I e-file my nj 1040nr, and what are the technical requirements?

Yes, you can e-file your nj 1040nr. To do so, ensure that your computer meets the required technical specifications, such as having a stable internet connection and compatible web browser. You will also need tax preparation software that is certified for e-filing New Jersey state returns.

What steps should I take if my nj 1040nr e-filing is rejected?

If your nj 1040nr e-filing is rejected, carefully review the rejection notice to determine the specific issue. Common reasons for rejection include incorrect information or formatting. Correct the identified issues, and then re-submit your return promptly to minimize any potential delays or penalties.

See what our users say